Bullet Bond ETFs

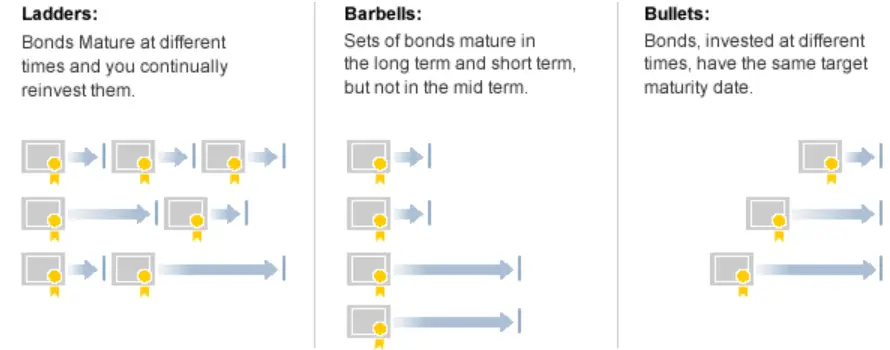

Your asset allocation has risk on one side and safer assets on the other. For instance, a 60/40 portfolio has 60% Stocks and 40% Fixed Income. Different ways of structuring your safer part of the portfolio include ladders, barbells, and bullets.

What are bullet bond ETFs, and how can you use them in your portfolio construction?

Bond Ladders, Barbells and Bullets

(source)

Bond ladders are pretty straightforward. If you want 30 years of retirement income, you can set up a TIPS bond ladder with bonds maturing yearly for the next 30 years. A barbell approach, on the other hand, has bonds with short and long maturity mixed. Bond bullets focus on bonds bought at different times with the same maturity date.

Bond Bullets are an asset-liability matching approach to investing. Say you need a lump sum of money in 10 years; you buy a bullet of 10-year maturity this year, nine years next year, eight years, etc.

What about retirement income? Instead of buying individual bonds, you can now buy Bullet Bond ETFs with specific maturity, which are more diversified than individual bonds.

What are Bullet Bond ETFs?

Bullet Bond ETFs are like other ETFs and trade while the market is open. You purchase a basket of bonds that all mature in the same year, and at the end of the target year, the fund is converted to cash and distributed.

So, at today’s rate, you can buy a basket of individual bonds that all mature simultaneously, get monthly income, and know that you will get whatever the stated yield is despite any changes in interest rates. A change in interest rates will affect the price of the ETF, but that doesn’t matter if you hold it to maturity.

Conversely, you can have capital gains or losses if you see the bullet bond ETF before maturity, depending on what interest rates have done.

Who offers Bullet Bond ETFs?

You can get municipal, corporate, and US treasuries (including TIPS) in Bullet Bond ETFs. IShares and Invesco have products to explore.

What is the Use Case for Bullet Bond ETFs?

As mentioned above, if you have a specific liability you have to meet in the future and want to do so with new (incoming) money, you can buy specific duration bonds to meet that liability.

In retirement, some people want their bonds to have specific dates of maturation to meet that year’s expenses. Instead of buying individual bonds, you can buy a Bullet ETF.

The idea is that as long as you hold the ETF to maturity, you will get the money you promised despite changes in interest rates. That is, bullet bond ETFs are not subject to changes in interest rates (you lock in your returns). This is also the case with aggregate bond funds, but only if you hold the fund to the average maturity (which will change while you own it). The traditional bond fund continues to buy new bonds with the stated maturity date, whereas bullet bonds don’t buy new ones as no bonds are maturing before the effective date.

Bullet Bond ETFs

In Summary, if you are using a bucket approach to retirement income, Bullet Bond ETFs may make a lot of sense. They are easier to purchase than individual bonds and work well in building a bond ladder. They pay monthly income and cash out when they mature, so they may be a better rung in a bond ladder.