Optimal Asset Location

Deep dive into Asset Location Optimization and Tax-Efficient Fund Placement. This is Asset Allocation in Multiple Accounts!

Deep dive into Asset Location Optimization and Tax-Efficient Fund Placement. This is Asset Allocation in Multiple Accounts!

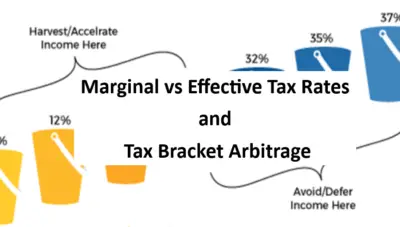

Tax Rate Arbitrage and Roth Planning Tax rate arbitrage is an important concept in retirement planning. You must understand tax rate arbitrage to buy the government out of your retirement. When should you harvest or accelerate income, and when should […]

Taxation of Long-term Capital Gains A separate (and some would say mystical) taxation system exists for long-term capital gains and qualified dividends. Let’s discuss the Long-Term Capital Gains Tax and how the standard deduction applies to capital gains. Ordinary income […]

Taxes in 2026 after TCJA Sunsets We are just two short years away from the 2017 TCJA (Tax Cut and Jobs Act) sunsetting, and taxes for physicians (both in accumulation and retirement) are set to increase. Since we only […]

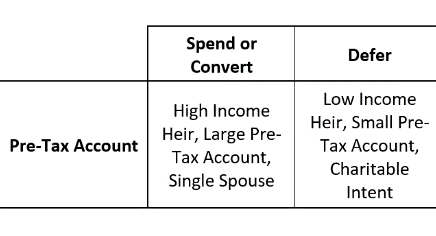

IRA Legacy Planning Let’s look at IRA Legacy Planning. IRAs are tax timebombs, and someone will pay the taxes. Who? You, Your Spouse, or Your Kids? Do you and your spouse want to pay the taxes or leave them for […]

SLATs If you have succeeded in gathering and protecting assets, you may have a Federal Estate Tax problem. Consider a SLAT. How about that for a new financial goal: I want an estate tax problem! Worried about Estate Taxes? […]

Tax Planning Window to Save in Lifetime Taxes What is the optimal time to do tax management for retirement? The tax planning window! Not infrequently, that tax strategy is a yearly series of partial Roth conversions. These pre-paid future taxes […]

Calculate MAGI for IRMAA and ACA Tax Credits The MAGI calculation for IRMAA and ACA Tax Credits is vital but usually glossed over. When faced with a difficult calculation, it is easy to wave one’s hand. MAGI is used twice […]

Non-Deductible IRA After-tax contributions to a traditional IRA are a common problem. These results in basis in your IRA. That is, you have money you have already paid taxes on in a usually pre-tax account where you still owe taxes! […]