3 or 4 Fund Portfolio?

Why do Bogleheads and Vanguard disagree about exposure to International Bonds?

Bogleheads advise a three-fund portfolio containing US and International equities (globally diversified) but submit that US bonds are sufficient. Vanguard recommends a four-fund portfolio that includes globally diversified bonds. Why does Vanguard add international bonds?

The Boglehead 3 Fund portfolio is well-documented, rational, and practical. Is cost-effective diversification added with international bond exposure?

The Unspoken Incongruity

International bonds are an unspoken disagreement between Vanguard and the Bogleheads. John Bogle not infrequently disagreed with Vanguard, so this is charted territory.

In 2015, Vanguard increased international bond exposure from 20% of bonds to 30% in both their target date products and AUM services.

The response from the Boglehead Forums I like best is:

First, if you have a high enough equity percentage with a decent percentage of international equities, you probably don’t need international bonds. However, once you get past a certain percentage of bonds in total, adding international bonds is a good idea–and it is a good idea precisely because it will likely lower portfolio volatility. (Source)

Rick Ferri says this about International Bonds:

They have higher fees than comparable US bond funds and hedging currency adds another hidden layer of cost… Vanguard talks about the *potential* for diversification. It’s not enough to peak my interest. Whatever benefit there *might* be from future low correlation isn’t going to make up the higher expense or lower yield. Maybe it did in the past, but not now. A diversified fixed income strategy does not need a hedged developed market international bond fund. (Source)

Rick thinks there are diversification benefits he can find at a lower cost.

International bonds earn Vanguard Money.

What Does Vanguard Say About International Bonds?

International bonds benefit when interest rates in foreign countries fall faster than in the US. However, since 2021, discussing this has been forbidden in the Boglehead Forum.

Meanwhile, Vanguard quietly retested its case in May of 2023. Their original white paper on international bonds is no longer on the internet, but I googled it and found that Vanguard still supports international bonds. In (Re)validating the case for international bonds, they say, “an investor with an allocation to international bonds benefits from diversified exposure to more securities (7,000 plus), yield curves, countries (40 plus), and macroeconomic regimes.” They say they don’t believe in diversification for diversification’s sake and point out that they don’t invest in junk bonds.

Vanguard believes in a 4 Fund portfolio with 30% of your bond exposure into international bonds but not in high-yield bond exposure.

Should You Add International Bonds to Your 3 Fund Portfolio?

So, Should you add international bonds to your fixed-income portfolio? I’d rather add bond-alternatives, but another consideration is below.

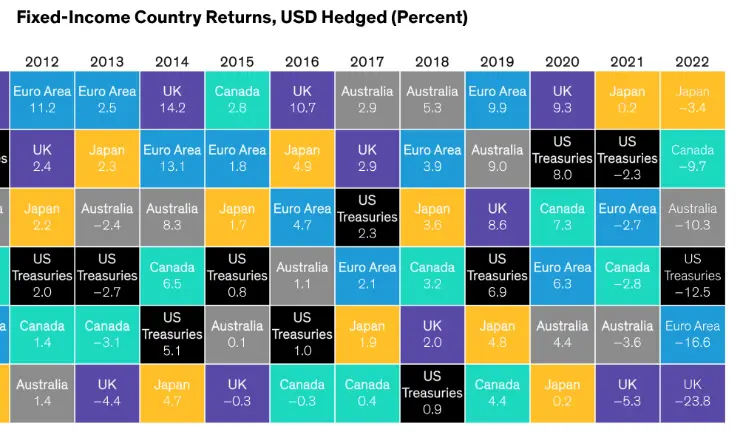

USD Hedged Fixed-Income Returns by Country

What are the returns of international bonds?

In Orange are Japanese Bonds. The “lost 30 years” of the Japanese stock market is in the last two years’ bond returns.

More pertinent are US Bond returns in Black.

Above, you can see the implication of international fixed income to a US investor. These returns are hedged, resulting from the US Dollar wrecking ball. The Dollar is as strong as ever, a headwind to international bonds.

US fixed income has not had a number-one result in the last ten years. The US is 4th out of the six countries in bond returns.

The best reason to invest in international bonds is that they are 52% of the bonds issued worldwide this year. US equity is more than global, but the opposite is true in bonds.

This is the Callan Table of bond returns. For the equity Callan Table, read this.

Three vs. four Fund Portfolio

Which should you have, a Boglehead 3 fund portfolio or a Vanguard 4 fund portfolio? If the idea is simple, should you add international bonds as a fourth asset class after three asset classes? I’d rather add small-cap value, but you can’t go wrong.