Non-Deductible IRA

After-tax contributions to a traditional IRA are a common problem. These results in basis in your IRA. That is, you have money you have already paid taxes on in a usually pre-tax account where you still owe taxes!

You get basis in your IRA if you contribute to an IRA though you have too much income to get a tax deduction on the contribution. Every year, you get to file a Form 8606 to track the basis in your IRA. And remember, due to the aggregation rule, all your IRAs (not Roth IRAs) are considered a single account for IRS purposes.

Let’s discuss non-deductible IRAs, including the Cream in the Coffee maneuver, and learn more about this complicated topic. Of course, you won’t need to know everything if you are doing the Backdoor Roth or the so-called Mega Backdoor 401k to Roth IRA Rollover, but if you need a reference, this is your comprehensive guide to non-deductible IRAs!

What is an After-Tax Contribution to an IRA?

Not infrequently, high-income folks continue to contribute to an IRA even though they earn too much to take a tax deduction. Since this money cannot be deducted for tax purposes, it is considered an after-tax basis in your IRA.

Anyone can contribute $ 6,500 a year ($ 7,500 if older than 50) if they have earned income (or a spouse that does—a spousal IRA contribution).

What is an after-tax contribution to an IRA? It is simply a contribution you make that you cannot deduct on your taxes because you phase out of the MAGI income limits. If you cannot deduct the money (and have it be “pre-tax”), then it is basis or after-tax basis in your IRA.

Not infrequently, CPAs don’t know what to do about this situation. They allow clients to continue making non-deductible contributions, and they may file form 8606 annually to track the after-tax basis. And sometimes form 8606 gets lost, so you might end up paying taxes on the after-tax money! Double taxation! Also, many CPAs are unfamiliar with the Backdoor Roth, so they haven’t been talking to their clients about converting those after-tax contributions to the traditional IRA into Roth—a tax-free event.

After-tax contributions to a traditional IRA will likely be around even if the Backdoor Roth goes away. Many folks contribute to the IRA every year regardless of MAGI.

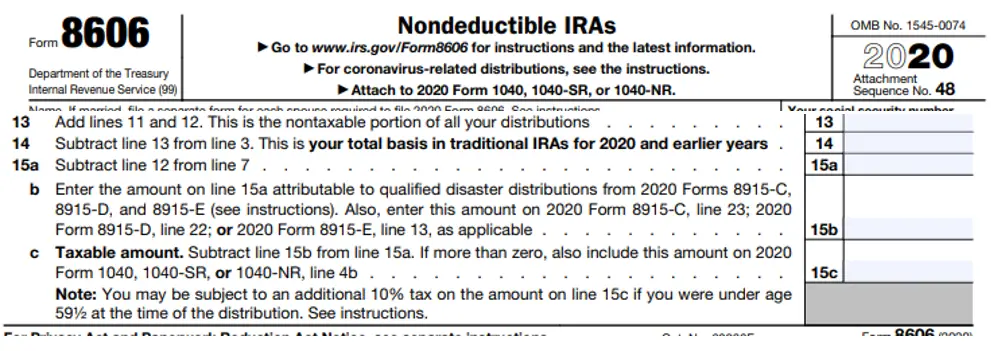

Since we will need to understand form 8606, let’s take a closer look

After-Tax IRA (Basis) and IRS Form 8606

Do you have after-tax money (also called basis) in your traditional IRA? This is an after-tax IRA.

The first thing to check is your most recent tax return. Do you see IRS form 8606? This is a form you (should) file yearly with the IRS to show how much basis you have in your IRA.

It is common for people to forget to file IRS form 8606 or drop it after a few years. Remember that the 8606 is not “proof” to the IRS that you have an after-tax IRA; it is merely a worksheet to keep track of it.

You can reconstruct your after-tax IRA if you have lost IRS form 8606 or are missing a few years. It is worth your time to do so now.

Above, you can see an example of IRS form 8606. The form is cut; I just wanted you to see what the top looks like so you can pull it to review your most recent tax returns.

Now, pay attention to line 14. Line 14 of IRS form 8606 has the basis (after-tax IRA) for this year and all earlier years. If this line is not correct, fix it, or you will pay tax again on money you already paid taxes on. Double taxation is not fun! You should avoid double taxation whenever possible!

Avoid Double Taxation of your non-deductible IRA

What happens if you forget to record your after-tax IRA basis?

A distribution from an IRA is fully taxable at ordinary tax rates unless you use IRS form 8606 to show you are taking a pro-rata tax deduction due to basis.

Don’t let money you have already paid taxes on be taxed again! Avoid Double Taxation!

This is important. If you don’t report that a distribution contains after-tax (basis) via the 8606 on your taxes, you will owe taxes on money that has already been taxed.

Remember, in the eyes of the IRS, you only have one IRA.

You may have a SEP and a SIMPLE and a rollover and three different other traditional IRAs. But the IRS doesn’t care about separate accounts. It is all one. This is called the IRS Aggregation Rule; you only have one IRA in the eyes of the IRS. If you have after-tax in one IRA (or keep one IRA separate just for your after-tax contributions) and try to convert it to a Roth, you will bump against the pro-rata rule.

It is common for people to forget to file form 8606 or drop it after a few years. Remember that form 8606 is not “proof” to the IRS that you have basis in your IRA, it is merely a worksheet to keep track of it.

You can reconstruct your basis in your IRA if you have lost form 8606 or are missing a few years. It is worth your time to do so now. Keep records of the basis you report on 8606 as this form is just a worksheet, not evidence in case of an IRS audit.

Understanding the pro-rata rule will go a long way to keep the IRS out of your life!

Pro Rata Rule and Getting Basis out of an After Tax Traditional IRA

Unfortunately, all growth of after-tax money in your traditional IRA is taxable! If you could convert it to Roth, future growth would be tax-free!

As I mentioned above, due to the aggregation rule, the IRS considers all your IRAs as a single account and values them once, on December 31st.

What is the pro-rata rule? It states that if you have after-tax and pre-tax contributions in your IRA, any withdrawal or Roth conversion comes out in proportion to the after- and pre-tax amounts.

If you have a small amount of after-tax contributions in your traditional IRA, you cannot do a Roth conversion of just the after-tax amounts, you must convert it pro-rata.

The Pro-Rata Rule

The pro-rata rule determines how much of a taxable distribution is when your IRA has both pre-tax and after-tax (basis) dollars. You take the ratio and then determine the taxable amount.

As a simple example, say you have 6k of basis and 6k of pre-tax in your IRA (as you might if you had a non-deductible IRA one year and deducted your IRA before). Then, if you distribute the money (or do a Roth conversion), you will pay taxes on 6/12 or 50% of the money (as long as you use 8606 to show your basis).

If you have a SEP or a rollover IRA with 600k of pre-tax money and 6k of after-tax contribution, then only 6/606 or about 1% escapes taxation.

This is the pro-rata or proportion you have after-tax vs. pre-tax in your IRA.

The pro-rata rule keeps many people from doing a yearly Backdoor Roth IRA. (It does not prevent you from doing the Mega Backdoor 401k to Roth IRA because this is done in a 401k and not an IRA.)

The Pro-Rata Rule and After-Tax IRA

The pro-rata rule keeps many people from doing a yearly Backdoor Roth IRA. (It does not prevent you from doing the Mega Backdoor 401k to Roth IRA because this is a 401k, not an IRA.)

Another way to think about the Pro-Rata Rule: Cream in the coffee.

Cream in the Coffee After-Tax IRA Roth Conversions

It is all mixed together if you have just a bit of basis (Cream) in your large IRA (the coffee). You can’t take a sip (a distribution or conversion) without getting both!

How can you get the Cream out? After all, the after-tax IRA growth means ordinary income taxes.

It would be nice to separate the Cream from the coffee so you can Roth convert the basis and get tax-free growth. You can, via the Cream in the coffee After-Tax IRA Roth Conversion.

Sometimes called the “cream in the coffee rule” (but it isn’t a rule), this is a great way to separate the Cream from the coffee. This is how to Roth Convert your after-tax IRA.

How to Do the Cream in the Coffee After-Tax IRA Roth Conversion

With the Cream in the coffee after-tax IRA Roth conversions, you take advantage of the fact that you can only rollover pre-tax money into a 401k. By law, 401k plans will only accept roll-ins of pre-tax money!

Say you have a 401k at work or a solo 401k from 1099 income. Most of the time (read the summary plan document), 401k plans allow roll-ins (because they want your money). However, by law, they only allow pre-tax money to be rolled in, never after-tax or Roth money.

So, if you have 6k of basis and 6k of pre-tax money in your IRA, you could roll in 6k to your 401k and then do a Roth conversion tax-free with the remaining after-tax IRA!

Or, if you have 600k of pre-tax money from a separate rollover, you could roll that money back into a current 401k to get that messy 6k of basis out of your 8606 and out of your life.

As long as you have a zero pre-tax IRA balance on December 31st (the only time the IRS applies the aggregation rule is on December 31st every year), you have done it! You Roth converted your after-tax IRA via Cream in the coffee rule!

Finally, remember you can do a once-in-a-lifetime HSA rollover (a QHFD) to eliminate a small amount of pre-tax money from your IRA. Fun fact.

Summary: Cream in the Coffee IRA

Using the Cream in the Coffee After-Tax IRA Roth Conversion, you can liberate your after-tax IRA and then convert to a Roth tax-free. This allows all subsequent growth of your Roth to be tax-free! We love Roth money. Partial Roth Conversions are a very important part of retirement planning.

This is important to consider if you want to do a yearly backdoor Roth IRA or if you have contributed to your IRA over the years and cannot deduct it.

Simply separate the coffee by rolling the pre-tax money into a 401k, and then Roth convert the after-tax IRA.

Now you know, and you can get your December 31st pre-tax IRA balance to zero and avoid the pro-rata rule. The Cream in the coffee after-tax IRA Roth conversion scores again!

Avoid double taxation and the messy IRS form 8606 with the after-tax IRA Roth conversion.