Retiring Physician Checklist

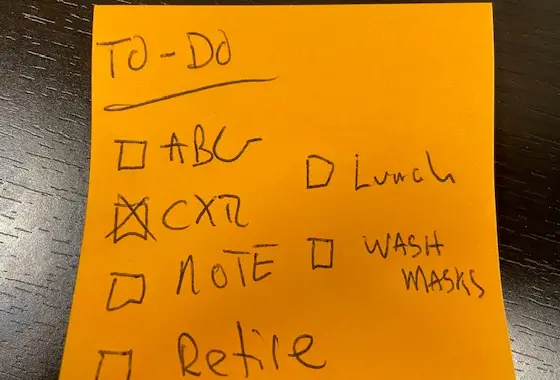

Physicians love to make lists and check off stuff. ABG, check. CXR, check. Notes and basic hygiene… later.

What about retirement? What items do you need to check off in your retiring physician checklist?

Retirement planning starts when you become interested in what you are investing in. In what you are invested.

What other issues must you consider as you get closer to retirement?

Let’s talk about a Retiring Physician Checklist.

Retirement Checklist for Physicians

What considerations are there for physicians when thinking about retirement?

Physician retirement is different. We are high earners but often start earning late and in debt. Physicians don’t discuss personal finance; when they do, it is not infrequently poor advice, and retirement planning is seldom raised as an item of discussion.

Let’s discuss the physician retirement checklist’s who, what, where, when, and why.

Who

In this instance, I am thinking about folks who have a $2M—$10M nest egg. Many, but certainly not all, physicians fall into that income category. I have a beef with giving general financial advice when you don’t know the net worth and risk tolerance of the people who need to make the plan. If you have less than $2M, there are different planning considerations than there are when you have more than $10M.

The following checklist is not specifically just for physicians but for those with a nice-sized nest egg. These are the retirement “problems” I like to think about, and the advice is difficult to get without paying an arm and a leg.

What

Some issues will be more critical than others for individuals, but you must at least consider every problem. Check the box.

Where

Where are you going to be when you retire? Are you moving? For instance, if you live in a state with no income taxes but plan to move to the coasts for retirement, you may want to consider doing Roth conversions now rather than waiting and paying higher state income taxes on the conversions.

When

If you can look at tax diversification and consider addressing sequence of return risk early on, you should start the process as soon as possible. This way, you might have a plan in place early to lower your taxes and mitigate sequence of return risk.

The Tax Planning Window is a necessary time you might have available to save on overall life-long taxes. After you stop making income and before Social Security (at 70) and Required Minimum Distributions (at 72) kick in, you must have a retirement plan.

Why

Why do physicians need a retirement checklist? Well, let’s stick to money here. You need to have some for the rest of your life. You might also have other goals, such as a legacy for your family or charities.

Have a plan and know it will not go as planned. But be able to pivot when things change rather than react.

How

Either DIY or hire help. Please note, however, that most financial advisors are good at accumulation and not so good at distribution or de-accumulation. As a result, the sales guy will want to sell you products, the AUM guy will want to keep your money to manage and may underplay the role of good annuities.

Note that physicians have a lot to learn about retirement, and the advice varies depending on the model.

Retiring Physician Checklist- GOALS

Goals are the most important part of retirement planning. So what do you want to do with your time and money?

You’d better figure out what you will do with your time.

What is the goal with the money? Do you want to spend it all? Do you want to leave a legacy for your children or charities?

If you have enough, you can decide who will pay the taxes. This is important as most retirees have plenty of pre-tax money, and the government will get more or less of it depending on your plan. Are you going to pay? How about your spouse when you die? Or your kids? Who is going to pay the taxes?

Once you understand your goals, you can complete the physician retirement checklist!

The Retirement Checklist for Physicians

Check the following boxes when you have a plan in place.

Here is your physician retirement checklist: Check the boxes.

□ Home

Where are you going to live? Is your mortgage paid off? When might you consider a mortgage in retirement?

Generally, there is no reason to carry a mortgage into retirement. Just pay it off. But actually, a Reverse Mortgage is for the Wealthy, too. Don’t throw up in your mouth with the mention of a reverse mortgage, but understand how accessing the equity in your home can be an essential part of the plan. If a reverse mortgage can save you from a significant tax payment on money you need early in retirement, it can be a massive win.

□ Debt

Leverage is for the young. Debt acts like negative bonds and increases your asset allocation. Pay off your debt before retiring.

□ Risk Level

Understand your risk tolerance and capacity to take risk. Consider Going Conservative for Retirement with a Bond Tent, or Decrease your Asset Allocation to prevent Sequence of Return Risk.

I can’t say this enough; it is vital to De-Risk before retirement!

Many people will want to reach for yield; instead, consider bond-alternatives.

□ Tax-Efficient Withdrawal Strategy

Taxes are going to be your most considerable known expense in retirement. Make sure you have a Tax-Efficient Withdrawal Strategy in place to address taxes.

Withdrawal Strategy in Retirement is a complicated process that begins by understanding all of your assets and their role in your retirement income plan. This is the meat and potatoes of efficient retirement planning, so don’t skimp on the plan.

Also, understand that taxes will increase if one spouse dies before the other! This is called the Widow/Widower Tax Penalty and can have significant tax implications. Someone will pay the taxes.

□ Partial Roth Conversion

Partial Roth Conversions are so important to folks in this income range that they need to check this box. Paying taxes now can be scary, but there are many reasons to do so. You can save in taxes over your lifetime by pre-paying taxes and leaving more for the kids.

Your average CPA will tell you that you don’t need to do Roth conversions, but they are wrong. If you are retiring with a large amount in your pre-tax accounts, you need a plan to do partial Roth conversions. As a Physician, at least consider de-bulking your IRA via Roth Conversions.

□ Expenses in Retirement

Expenses are like a smile. They start higher and go down over time as you do less. Then, near the end, they increase due to healthcare expenses. So make sure you understand the Spending Smile and Lumpy Expenses.

Consider Stress Testing Your Portfolio Before Retirement. Most folks in the income range I’m talking about will have plenty but have a plan.

□ Long-Term Care Insurance

If taxes are the largest known expense, long-term care might be the largest unknown or lumpy expense. That said, traditional Long-Term Care insurance is expensive and may not be available when you need it, and hybrid LTCI policies are poorly understood by the folks who sell them.

Decide now if you want long-term care insurance or can self-fund your long-term care needs.

Long-Term Care insurance is complicated and likely not necessary if you can self-fund.

□ Health Care

This is a financial blog, but it is amazing how little we physicians know about Medicare, Medigap, Part B, and D, and the list goes on.

When it is time to sign up for Medicare, it pays to take some time to read about it and understand your options.

You will discover that IRMAA is a concern for retired physicians. IRMAA is a cliff penalty, which means if you go a dollar over your modified adjusted gross income for IRMAA, then you owe surcharges (a tax on the rich) for a whole year for both you and your spouse.

□ Pensions

If you have a pension, you will need to do some math to determine if you want the lump sum or to take the monthly income. Generally, if you have plenty of other money to spend, having a constant stream of income you can’t outlive is golden.

□ Cash Buffer

I like to have 2-3 years of cash on the side and refill it once a year when you re-balance and take RMDs. If the market is up, refill cash from equities. If the market is down, refill your cash buffer from bonds. This is how you rebalance and may help you have a Rising Equity Glidepath.

□ Safety-First

There are excellent reasons to floor your known ongoing retirement expenses. You should consider having continuous, steady, guaranteed income above and beyond social security. This is the Safety-First Model of retirement.

Annuities are a four-letter word, but SPIAs and longevity annuities have their rightful place in physician retirement planning. It is a complicated topic, but start here: SPIAs and QLACs in Retirement.

Having an annuity instead of bonds will let you leave more behind if you live past an average life expectancy. Think about it.

□ Simplify the Retiring Physician Checklist

If you have multiple 401k/403b/457/IRAs, it might be time to roll everything into one account. Not only is this simpler for you when you have to take RMDs, but it will also be easier on your spouse if you pass. Remember, these accounts pass on via beneficiary forms, so keeping them accurate is super important to your estate plan. Also, remember that Non-Governmental 457’s must be addressed separately as they cannot be rolled into an IRA and have district distribution options.

Each 401k will send you an RMD, whereas you are responsible for your RMD from IRAs. The IRS views all your IRAs as a big pile of money, so you can take RMDs from any account for all of your IRAs. But it may be simpler to have a single account and a single RMD.

□ Estate Plans

You might want to list your spouse first and your children as contingent beneficiaries if you have enough money. This allows you to “cascade” the money upon the first spouse’s death.

This cascading estate plan is especially important after the death of the stretch IRA. When the first spouse dies, the remaining spouse can keep what they need from the IRA and disclaim the rest. The kids can stretch out the disclaimed amount over the next ten years. If the remaining spouse lives for ten more years, the rest will come out over the next ten years.

While you likely don’t need a fancy estate plan if your assets are less than the Estate Exclusion amount ($11M per individual currently), just having a will is not enough.

Finally, consider a SLAT if you are worried about Estate Taxes.

□ Social Security

Social security is mostly an afterthought. That said, I have a long, detailed blog about the details of social security and why you should delay taking it until you are 70, especially if you are married and a high-income earner.

If you have a short life span or plenty of money, it doesn’t matter when you take it. After 85% of it is dragged into taxable income, it may just pay your IRMAA surcharges.

Physician Parents know Breathing is the only important thing to ensure your kids are still doing… at least when they are young and crazy.

Retiring Physician Checklist: The Endgame

That is a long list of things to consider before retirement. If you’ve had young, wild kids, you know the first thing to check is that they are breathing. Very often, that is the only thing you need to know.

Retirement is different. There will be times of difficulty. You don’t need to be perfect, but it’s important to have a plan to deal with most of the knowns and known unknowns.

You made good money and have done well for yourself. Understand your retirement’s financial goals, and ensure you understand your asset allocation five years from retirement.

Once you know your goals, use the retiring physician checklist to check off topics to contemplate before retirement.