Moving to a De-Accumulation Portfolio in CoastFI

Typical retirees use bonds to reduce sequence of returns risk in retirement. When you are CoastFI, you aim to earn enough money to pay the bills and let your retirement accounts compound in the background. As such, when considering your asset allocation, you must consider retirement date risk rather than sequence of returns risk.

Still, at some point, it is prudent to eliminate risk and have a more conservative asset allocation.

How should you consider moving to a de-accumulation portfolio when you are CoastFI?

Retirement Date Risk

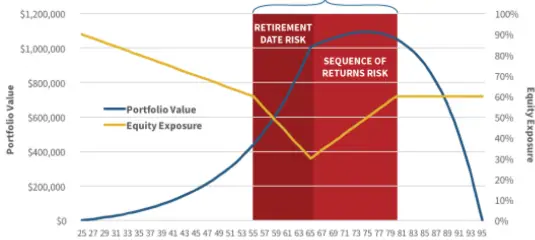

Retirement date risk may be a new term for some. Below, you can see before you retire at age 65, you have retirmenet date risk, and after you retire you have sequence of returns risk.

This graph is from Kitces’ work on bond tents. The yellow line is equity exposure, so he demonstrates a sharp decrease in equities in the decade before retirement and then an increase after retirement. Bond tents and rising equity glidepaths are interesting ideas and a good consideration for your long-term post-retirement glidepath.

However, when CoastFI, you also have retirement date risk. Since you make enough money to pay the bills, your portfolio does not have to be stressed to provide income, and you can have an aggressive asset allocation. But you have won the game at some point, and it is time to de-risk.

Accumulation is Easy!

Most agree that you should be 80% or more in equities during accumulation. As you earn money, dollar cost average into low-cost, broadly diversified funds, allowing compounding over the decades. Accumulation is easy!

Everything changes in De-accumulation

Once you rely on your portfolio for income, you must guard against a sequence of poor equity returns that will force you to sell equities low and lock in losses.

Traditionally, retirees have 40-70% in bonds and cash to guard against being forced to sell equities low. As we saw in 2022, bonds and stocks can be correlated, especially during market stress.

For the last three years, I have been figuring out how to use other asset classes that may correlate less with stocks and bonds, especially during times of chaos. Buffer assets are non-correlated, but most people don’t have cash-value life insurance or take out a reverse mortgage.

“All-weather” portfolios have been bandied about over the last few decades. Perhaps the most recent iteration is a modification of risk parity portfolios. I am grateful to Frank Vasquez for his work on the topic, and it has influenced me to move from 100% equities to a de-accumulation-style portfolio. The goal is to find non-correlated asset classes.

Less Correlated Asset Classes

They say all correlations go to 1 during market crashes, which is largely true. There are no non-correlated assets, but let’s look at some less correlated asset classes.

Gold

I have replaced 2% of my large-cap growth with GLDM. This should probably be in a tax-protected space, but since I have plenty of room in my brokerage account, this is where my gold is. Gold doesn’t pay dividends, so it is mostly tax-efficient until you sell it. Once you sell gold, it is considered a collectable; thus, the highest long-term tax bracket is 28% rather than 20% for usual long-term capital gains.

Trend Following or Managed Futures

I have been excited about managed futures for a few years, but I finally sold various small positions and now have 4% of my portfolio in managed futures. A few ETFs are interesting, and one might consider owning several rather than a single one.

Bonds

Earlier this summer, I closed out a margin loan and went from 110% stocks to an asset allocation of 92% stocks and 8% bonds. An emergency fund is short-term, and for fun, I bought some 3-year bullet bonds. Most of my bonds are in a total bond fund.

Moving to a De-Accumulation Portfolio in CoastFI

In summary, it is easy for a physician to earn enough money to pay for expenses yet get premium ACA tax credits. I have retirement date risk because, as eventually, I’ll get sick of working and actually retire. At that point, a series of Roth Conversions make sense to optimize the 15% tax bracket over a long, traditional retirement.

My asset allocation is 84% stocks, 8% bonds, 2% gold, and 4% managed futures. The optimal level of gold may be 10-20% (my goal is 10%), and theoretically, at least, the optimal level of managed futures is as much as you can tolerate. My goal for managed futures is 20%. I’m unsure about leverage in retirement, but the idea of return stacking interests me.

And when do you rebalance in retirement? The data are poor, and there is an advantage to rebalancing in retirement unless you are doing it to control risk. I’ll consider further changes next summer.