Portfolio Makeover by Jean-Paul Sartre

If you are considering retirement in a couple years, it’s time to prepare your portfolio.

While “Portfolio Makeovers” are popular, a superficial change in the appearance of your portfolio is not enough.

Jean-Paul Sartre would suggest a portfolio metamorphosis (which implies a sudden change from an immature to an adult form) is necessary before retirement.

Don’t be a “normal” investor. Instead, choose and take control of who you ask for advice!

So, since Sartre says you need to change your asset allocation before retirement, let’s see what he says about investment advice.

Sartre’s Investment Advice

Ok, so according to JP Sartre, why take control of your portfolio?

Because, fundamentally, no one cares about your money as much as you. There is plenty of help available, but as Sartre says, who you choose as an advisor implies the advice you get. When you choose your advisor, since you know what they will say in advance, you determine the advice you will receive. And the cost.

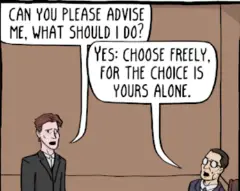

Choose freely your investment advisor, for the choice is yours alone. Who you pick determines what you get. Freedom of choice implies knowing that if you are wrong, only you will suffer.

Remember, investing is not an existential crisis: it is common sense. Which, of course, is uncommon.

If we take Sartre’s advice to heart, who you ask pre-determines your outcome. So, be careful to whom you look for advice.

Who Should Advise Your Portfolio?

Let’s be honest: few have their investment portfolio dialed in exactly as they would like. There are legacy positions from past advisors and hot stock tips from the doctor’s lounge. You might have sector funds or expensive, loaded mutual funds. Or individual equities. Or worse. That’s ok. We all do!

You desire low-cost simplicity.

You understand that the market goes up and down, and you search your couch cushions for change to invest when the market tanks. You know it isn’t different this time, and you understand the academic literature on investing (think Fama and French) and common sense low-cost investing Jack Bogle (fundamentally, cost matters). [affiliate links to recent books that are worth your time]

You know Rick Ferri and have read “150 Portfolios Better Than Yours.”

Who should makeover your portfolio? You. You are ready.

Sartre’s Asset Allocation Advice

Sartre says that you need to be ready to change your immature portfolio to your adult one.

Below we look at the metamorphosis you look to see in your pre-retirement portfolio:

Asset Allocation

Know why asset allocation is important, and state your desired asset allocation (my goal is 70-80% equities or 75/25 ish).

Cost

Above all else, cost matters. Yes, you can outperform a low-cost, broadly diversified total stock market ETF, but you cannot do it consistently after considering expenses. If you are actively investing, you do it for fun, not to make more money. You get what you don’t pay for.

Diversification

As it is oft said, diversification is the only free lunch in investing. So eat lunch every day, but not more than that. Don’t over-diversify (think cost and complexity).

Simplicity

You cannot overthink investing. You should set up your portfolio correctly (“good enough”) and then not look at it again for months or years. Remember that complexity is expensive and confusing. You don’t need that structured product or that fancy annuity.

Tax-Efficiency

Finally, if you invest with tax efficiency in mind, you will beat the pants off someone who only cares about returns. It is not how much you make but how much you keep.

How To Take Control of Your Investment Portfolio

Ok, so here is where the rubber hits the road. You know who your advisor is. Hint: it is not the insurance person, the broker-golfer, or the AUM industry that collects your sticky money.

As Sartre says, you are your investment advisor.

Sartre Says Be Your Advisor

He didn’t say that, but he did say choose freely, for the choice is yours alone.

Jean-Paul Sartre’s advice is that you need to understand yourself. Here is what I think:

Buy and hold. Buy everything and never sell (until you need the money). Know what you are buying (don’t get sold anything).

And more important than any other investing advice: know the purpose of that money.

Finally, who you ask for advice determines what you want in the first place.

Who you ask for advice determines what you want.

Portfolio Makeover by Jean-Paul Sartre

Finally, after the metamorphosis, your portfolio is resilient. Ask your new portfolio what you should do if there is inflation, volatility, or any other (minor) catastrophe in the stock market. The answer is always: “Well, nothing.” Once you set things up correctly, there are few reasons to look at the stock market again.

Jean-Paul Sartre’s Portfolio Makeover is: do it yourself. Simple, low-cost, diversified, and tax-efficient.

Become a butterfly. Understand who you ask for advice is how you will succeed. You must ask yourself first.